| Sr. No | Product Name | Video Link | action |

|---|

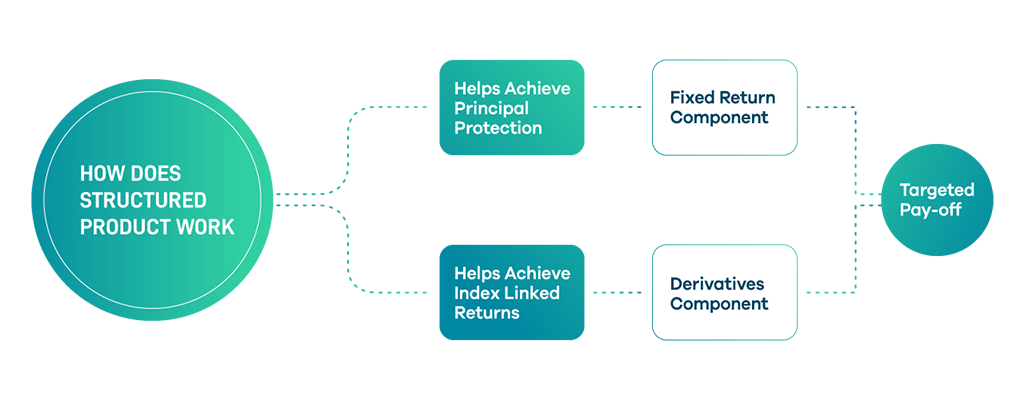

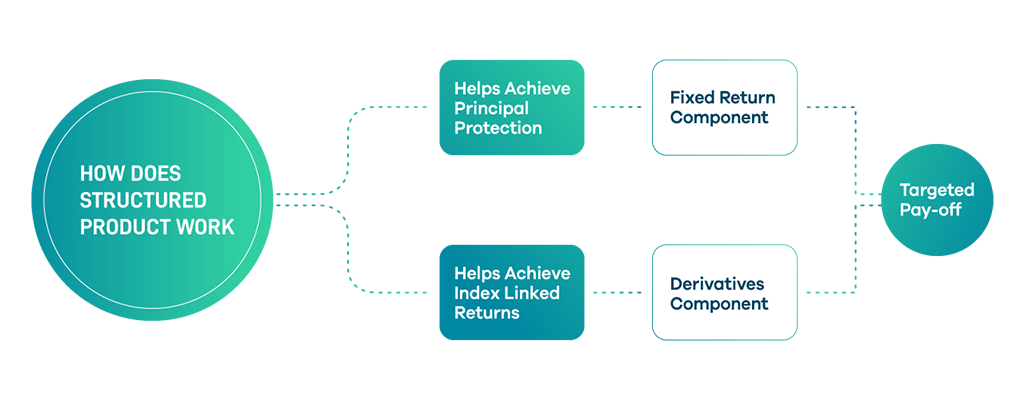

Structured Product’s or Market Linked Debentures (MLD’s) are pre-packaged investment products where the returns are linked to an underlying asset with pre-defined features (tenure, coupon, capital protection level, etc). They are aimed at providing targeted ROI/Payoff to investors. Structured Products are essentially a combination of debt and derivatives which the issuer manages to ensure the targetted pay-off is achieved. Structured Products are highly customizable, and can be offered as Principal Protected or Non Principal Protected investment options. It is the flexible nature of these investment strategies which make Structured Products a better investment vehicle to invest in an asset class as compared to traditional instruments. The investor can select the customized payoff from the specified underlying asset class based on his risk/return objectives. Structured Products may also provide better tax efficiency as compared to traditional investment options.

At Abans Investment Managers, we offer various Structured Product/MLD options to investors across asset classes all in addition to Equity linked structures (ie Nifty Linked Debentures). The debentures are held in the investor’s demat account.

Valuation of existing MLD by CARE Risk Solutions Private Limited

To download Terms and Conditions for MLD click here