Useful links

Product Offerings

About

Contact Us

- 36, 37, 38A, 3rd Floor, 227 Nariman Bhavan

- Backbay Reclamation, Nariman Point

- Mumbai - 400 021

- + 91 022 68170100

- service.abansim@abans.co.in

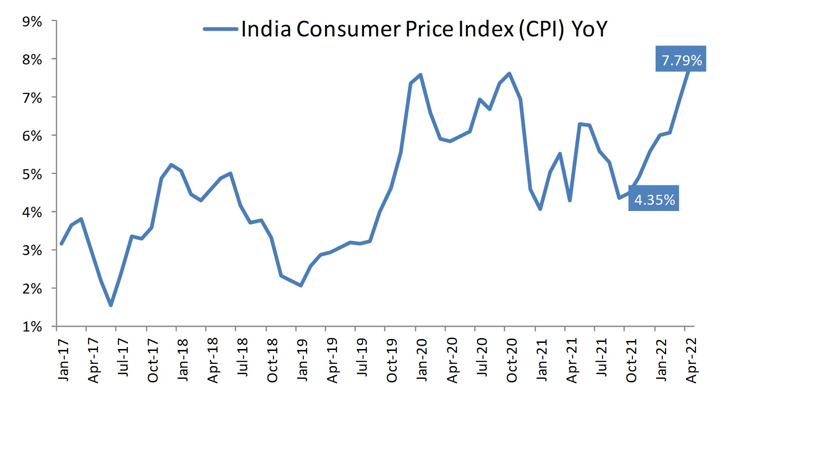

The Reserve Bank of India (RBI) has now entered the fray, putting the need to "keep inflation and inflationary expectations in check" at the forefront of its policy approach.

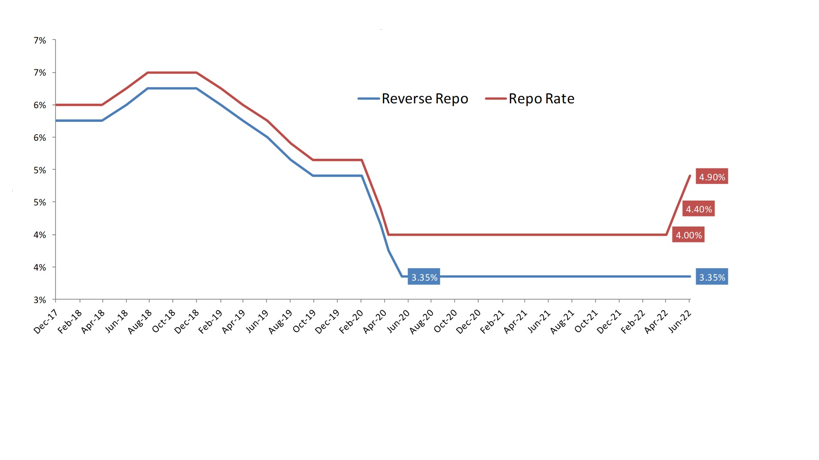

Within a month of the RBI's Monetary Policy Committee (MPC) deciding to raise interest rates by 40 basis point for the first time in nearly four years in an unexpected 'off-cycle' meeting, the rate-setting panel has increased the policy repo rate again by 50 basis points during meeting concluded on 8th June 2022.

At the same time, the MPC has stated that it will no longer "be accommodating." Instead, it will focus on withdrawing the pandemic-induced accommodation as it races to keep retail inflation within the 2 percent -6 percent target band. Let us take a look at the RBI monetary policy meeting and governor's address on June 8, 2022-

Policy Stance: ‘withdrawal of accommodation’

Repo-Rate- The Reserve Bank of India (RBI) has raised the repo rate by 50 basis points, an increase for the second time in five weeks at the conclusion of the monetary policy committee's three-day meeting on June 8.

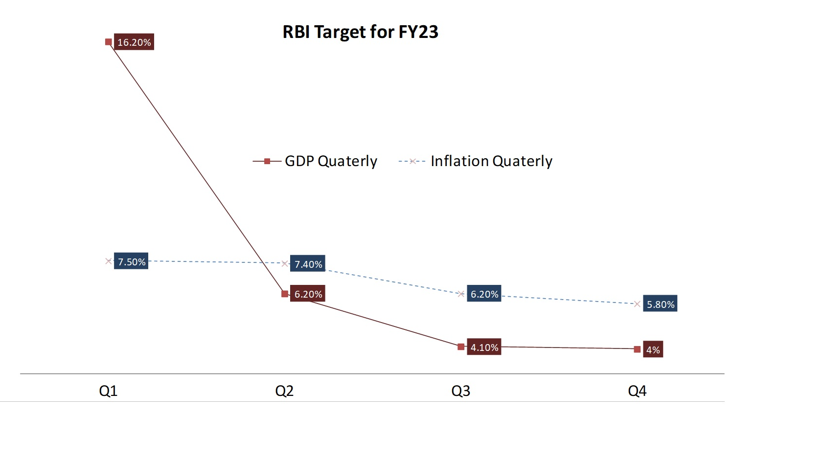

Inflation Target – For the last few years, India's inflation has remained stubbornly above target, and it has risen sharply in recent months as a result of ongoing supply chain disruptions caused by the Russia-Ukraine war. The RBI has raised its FY23 CPI inflation forecast to 6.7 percent from 5.7 percent. Inflation is now expected to be 7.5 percent in the first quarter, 7.4 percent in the second quarter, 6.2 percent in the third quarter, and 5.8 percent in the fourth quarter.

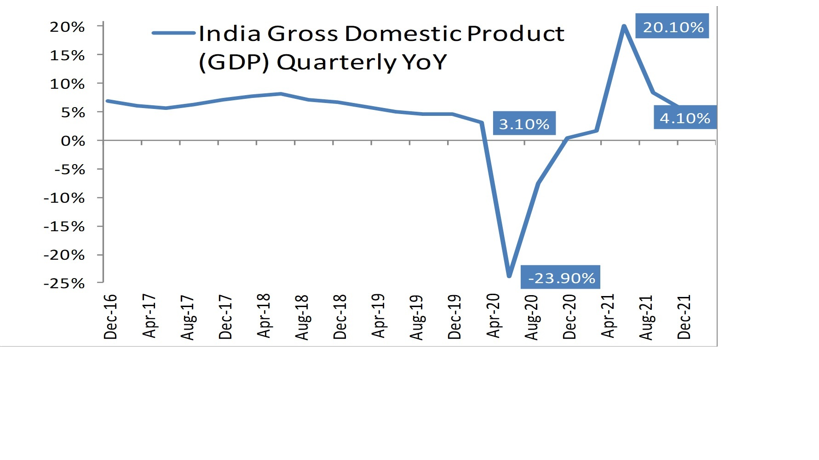

GDP Target - Rising inflation, supply chain disruptions, and geopolitical concerns have reduced the World Bank's FY23 economic growth forecast for India to 7.5 percent, from an earlier estimate of 8 percent. However, according to the RBI policy statement, real GDP growth is likely to remain at 7.2 percent in 2022-23, with Q1 at 16.2 percent, Q2 at 6.2 percent, Q3 at 4.1 percent, and Q4 at 4.0 percent, with risks broadly balanced. Meanwhile, the real GDP growth rate in 2021-22 is expected to be 8.7 percent. The level of real GDP in 2021-22 has surpassed the pre-pandemic level (2019-20).