Useful links

Product Offerings

About

Contact Us

- 36, 37, 38A, 3rd Floor, 227 Nariman Bhavan

- Backbay Reclamation, Nariman Point

- Mumbai - 400 021

- + 91 022 68170100

- service.abansim@abans.co.in

All investments include some level of risk. Stocks, bonds, mutual funds, and exchange-traded funds can all loose value if market circumstances deteriorate. Inflation risk exists even in conservative, guaranteed assets such as certificates of deposit (CDs) issued by a bank or credit union. They may not earn enough to keep up with the rising expense of living over time.

When you invest, you make decisions about what to do with your money. Risk is defined as any uncertainty about your investments that has the potential to harm your financial well-being. For example, market circumstances may affect the value of your investment to grow or decline (market risk). Corporate actions, such as whether to enter a new market or combine with another firm, can have an impact on the value of your investments (business risk). If you have a foreign investment, happenings in that country might have an impact on your investment (political risk and currency risk, to name two). In a nutshell, risk is the probability of a bad financial result that is important to you occurring.

There are, however, a few sophisticated ways to limit risk utilising products that provide assurance that your wealth will be secured. You can also outperform the benchmark investment returns depending on the sort of investment you pick. These structured products comprise a pre-packaged investment plan that often includes interest-linked assets as well as one or more derivatives. Its major goal is to protect investors' wealth in the case of a market downturn while also providing them with opportunities for capital appreciation by participating in stock market upturns.

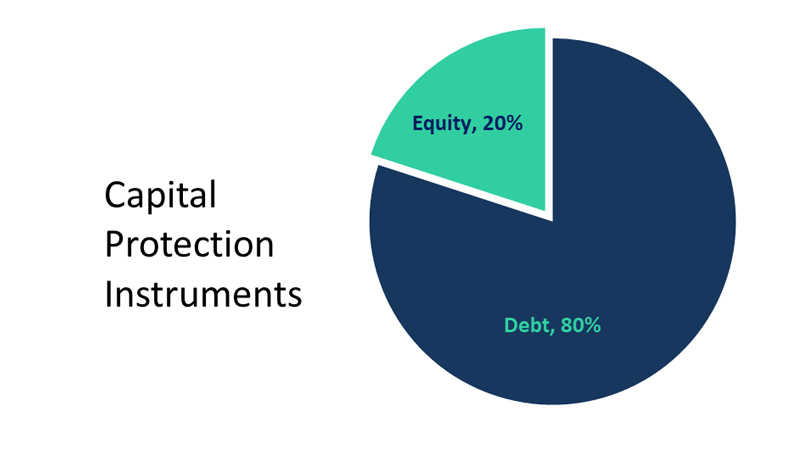

The capital protection instrument portfolio is made up of a combination of equity/commodities and debt, with the majority of the portfolio invested in debt and just a minor portion in equities/equities derivatives/commodity or commodity derivative. The debt portfolio's maturity and the funds' lock-in term are synchronized, further protecting it from erratic interest rate changes. Because these debt instruments are kept until maturity, the risk of interest rate fluctuation-related market-to-market losses is reduced.

A substantial portion of the corpus is placed in high-rated fixed-income securities to receive guaranteed returns, with the remainder put in equities to gain further profits. The fund's capital protection orientation means that the debt component is handled in such a way that the returns from it rise to match the amount of initial capital invested.

Capital protection vehicles often invest a significant portion of the overall investment amount, around 70-90%, in high rated debt instruments such as A or better rated bonds. The remaining 10-30% is invested in equity/commodity derivatives to ensure the promised returns are achieved.

As a result of the fund's design, regardless of how the equity market performs during economic downturns, the principle amount is safeguarded. At the same time, most of the times the products are designed to provide guaranteed out-performance to underlying indices like Nifty 50 index. Where most of the actively managed large cap mutual funds are finding it difficult to out-perform their benchmark index, Structured Products with more than 100% participation ensures the investors get guaranteed out-performance to Nifty while on the downside the principal stays protected. Inclusion of these products in investor’s portfolio can help achieve better outcome.

Let's look at an example to assist you understand. Assume a capital protection instrument has a Rs 10,00,000 investment corpus for 2 year tenor. It invests around Rs.8,20,000 in debt instruments with a two-year yield of 10%. This assures that the debt investment's maturity value is Rs. 10,00,000. The remaining Rs 1,80,000 is put in Nifty derivatives. At the end of 2 years, the debt component would grow to Rs. 10,00,000 after including the interest and the fund allocated towards Nifty derivatives will generate Nifty linked returns if Nifty was to go up in these 2 years. If Nifty was to generate negative returns, the funds allocated to derivatives will become zero but in that case investor at least gets capital protected unlike a stock portfolio or mutual fund where the investor might have lost part of capital.

If capital safety is the primary goal, capital protection instruments are considerably superior to alternate products like direct equity or mutual funds. In the passive investing segment, these instruments are fast gaining traction as it not only achieves the “passive investing” benefit of focusing on index, but through design it protects principal in downturn as well as provide higher upside then index through higher participation.